Singapore has cemented its position as a leading Singapore ESG Finance Hub, demonstrating that sustainability and profitability are mutually reinforcing. Through a combination of robust government policies, active financial institutions, and strategic global partnerships, the nation is setting the regional standard for green and sustainable finance.

Building the Foundation: Singapore ESG Finance Hub

In October 2022, Singapore launched the ESG Impact Hub, a space designed to promote collaboration in ESG finance. Supported by the Monetary Authority of Singapore (MAS), it hosts major programs such as the Point Carbon Zero Program with Google and the ESG Business Foundry with KPMG.

The Hub acts as the anchor for industry-driven sustainability efforts under Project Greenprint. This includes several key platforms:

- A Common ESG Disclosure Platform to simplify reporting and transparency.

- Data Orchestrators and ESG Registries using blockchain for trusted verification.

- A Greenprint Marketplace connecting tech providers, investors, and green solution partners.

Together, these initiatives strengthen Singapore’s digital and financial infrastructure to support ESG innovation.

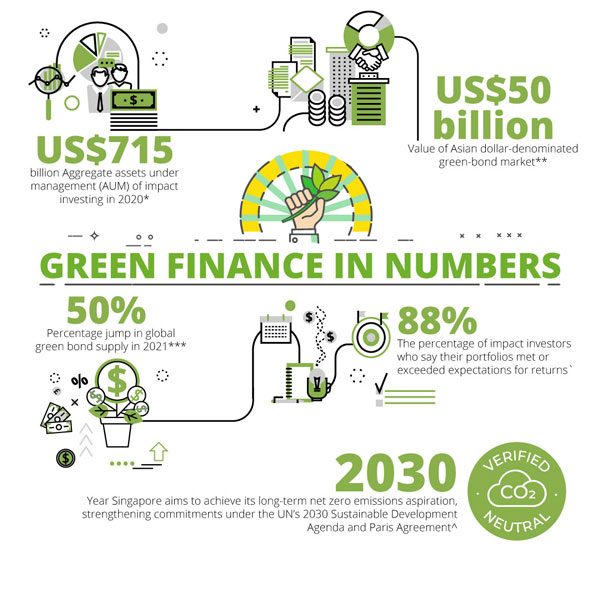

A Market with Massive Potential

The scale of growth is striking. The Singapore ESG Finance Hub market reached USD 30 trillion in 2024, with projections to reach USD 50 trillion by 2033. This surge shows increasing investor trust in sustainable assets and reflects Singapore’s strategic role in driving responsible finance.

Banks and funds are aligning with this momentum. ESG-linked loans and bonds are now a key part of financial portfolios. Companies that secure green certifications or commit to decarbonization plans are receiving better financing terms, signaling a clear shift toward sustainability-led growth.

Read Also: How Fintech Fuels Singapore Green Financing Ecosystem

Growing Momentum in Singapore ESG Finance Hub

Singapore’s green and sustainability-linked loans have grown for six straight years, reaching S$25.2 billion. This steady rise demonstrates market confidence and maturity in the ESG financing space.

Another milestone is the Green Investments Partnership fund, which achieved its first close with US$510 million of committed capital from global and institutional investors. The fund’s mission is to catalyze more ESG financing and channel investments into impactful projects across the region.

Singapore’s Regional Role in Green Finance

Southeast Asia requires around US$1.5 trillion in green investments by 2030 to achieve sustainable transition goals. Singapore, already a key financial hub, is positioning itself to drive this movement.

The FiNZ Action Plan by MAS aims to boost climate financing and help industries shift toward net zero. Singapore’s policy strength, transparency, and global network make it a natural hub for ESG instruments and services.

At the international level, Singapore pledged SGD 669 million at COP29 for climate action in Asia. It also committed to match up to USD 500 million for regional green and transition projects. These commitments reinforce Singapore’s credibility as a climate finance leader.

Read Also: Singapore Green Finance Leadership Launches US$2B Green Transition Facility

Landmark Deals Strengthening the Hub

The S$2.25 billion green loan to AirTrunk stands out as a landmark deal. It shows that Singapore’s financial ecosystem is capable of handling large-scale green financing, a sign of strong institutional confidence and expertise.

Such transactions position Singapore not only as a facilitator but also as an innovator in ESG finance, bridging capital and sustainable development goals.

Singapore ESG Finance Hub: The Road Ahead

Singapore’s ESG finance landscape is moving fast. With strong government support, private sector engagement, and a clear digital infrastructure, it is well on track to be Asia’s center for sustainable finance. As capital flows into climate-positive ventures and data-driven ESG tools expand, the Singapore ESG Finance Hub will continue to play a vital role in shaping Asia’s sustainable future.

FAQs

1. What is the Singapore ESG Impact Hub?

It’s a collaboration space launched by MAS in 2022 to promote ESG finance and innovation across industries.

2. How large is Singapore’s ESG investment market?

It was valued at USD 30 trillion in 2024 and is expected to reach USD 50 trillion by 2033.

3. What is Project Greenprint?

An MAS-led initiative that builds digital infrastructure for ESG reporting, data sharing, and investment connections.

4. What role does Singapore play in Asia’s green finance?

Singapore acts as a regional hub for mobilizing funds and creating frameworks that support sustainable transition projects.

5. What is a recent example of Singapore’s ESG financing strength?

The S$2.25 billion green loan to AirTrunk highlights Singapore’s capacity to secure and manage major sustainable finance deals.