Trade between Southeast Asia and the Gulf Cooperation Council (GCC) surged to $130.7 billion in 2023. It’s expected to climb another $50 billion by 2027, proving how quickly Asia-GCC trade is expanding. Behind this growth lies a new digital bridge built on innovation, regulation, and partnership. It's the DBS-BSF alliance, positioning Singapore at the heart of this Singapore Asia-GCC Payment Corridor.

A Rising Singapore Asia-GCC Payment Corridor Anchored in Growth

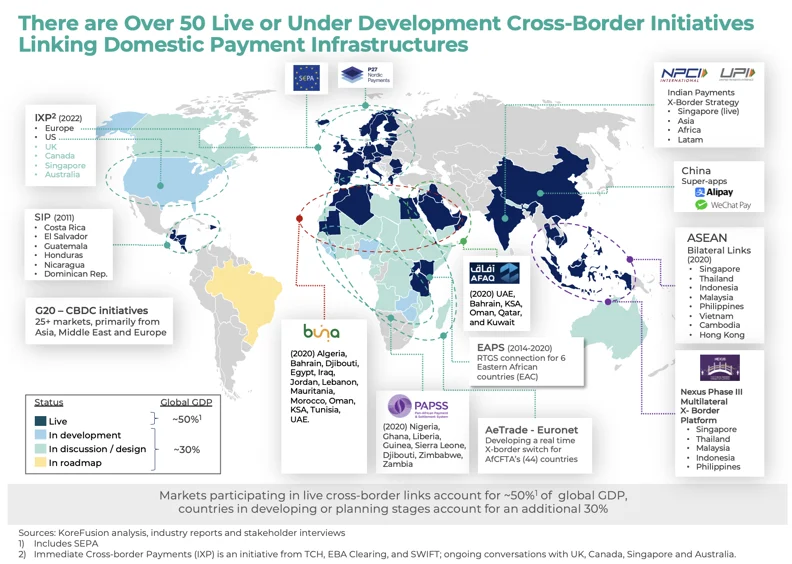

The Asia-GCC corridor connects two of the world’s fastest-growing regions. As demand for efficient, reliable, and real-time payments grows, the need for a shared digital foundation has become clear. This is where Singapore steps in. Not just as a neutral hub but as a driver of fintech infrastructure connecting East and West.

The DBS-BSF partnership, announced in October 2025, is a turning point. It strengthens digital trade and payment flows between Asia and the Middle East. The move highlights Singapore’s role in building an ecosystem where banks, businesses, and regulators collaborate to simplify cross-border transactions.

DBS’s Fintech Leadership Shapes the Singapore Asia-GCC Payment Corridor Network

DBS Bank, Southeast Asia’s largest bank, has long been a front-runner in digital finance. Its integration with China’s Cross-Border Interbank Payment System (CIPS) has already given Singapore a major foothold in Asia’s real-time payment networks. This allows faster, safer, and more transparent international transactions — a critical feature in modern trade.

With this foundation, DBS now extends its reach to the Middle East through Banque Saudi Fransi (BSF). Together, they aim to create a unified payment corridor that cuts through regional complexity, making trade smoother for businesses on both ends.

Partnership Backed by Measurable Momentum

The DBS-BSF alliance isn’t just symbolic; it’s backed by real results. BSF’s trade finance revenue grew 8% year-on-year in 2023, and contingent volumes increased over 15%, showing strong demand for digital trade solutions.

Even more telling, the partnership projects an 18% annual rise in transaction volumes, along with 12-9% growth in digital services. These numbers show that the Singapore-led payment corridor isn’t just an idea, but a fast-growing reality reshaping how Asia and the Middle East trade.

Fintech, Regulation, and Trust at the Core of Singapore Asia-GCC Payment Corridor

For a payment corridor to succeed, innovation must align with regulation. The DBS-BSF collaboration adheres to DEFA and CFES standards, ensuring that digital transformation stays compliant and secure. This balance between innovation and oversight strengthens trust, an essential currency in global finance.

Read Also: Digital Spend Slows in Singapore, but Still Strong. So What's Changing?

The partnership also aligns with Saudi Vision 2030, which seeks to diversify the kingdom’s economy and expand digital financial infrastructure. By supporting these goals, Singapore and DBS help create a bridge that serves both regional development and global trade ambitions.

Singapore’s Expanding Role in Cross-Regional Trade

The success of this partnership goes beyond numbers. It shows how Singapore is evolving from a trade facilitator to a strategic orchestrator of digital finance. Through partnerships like DBS-BSF, the city is proving its capability to connect Asia and the Middle East — two regions that together represent a major share of global trade growth.

As trade volumes surge and payment systems converge, Singapore’s advanced fintech ecosystem ensures it remains at the center of cross-border innovation.

Read Also: The Role of Singapore Digital Finance Research Globally

Explore the Singapore Asia-GCC Payment Corridor

The Singapore Asia-GCC Payment Corridor is more than a link. It’s a framework for the future of trade. For businesses aiming to expand into Asia or the GCC, now is the time to explore this opportunity. To learn how to navigate this evolving corridor or develop a stronger trade strategy, reach out to Market Research Singapore, a global consulting firm helping businesses scale across markets and unlock growth through cross-regional expertise.