Singapore is reshaping its global role through a bold push into sustainable finance. This shift has sparked what many call the Singapore Green Fintech wave. The city-state now aims to become the world’s “Green Finance Controller,” using strict climate-reporting rules and fast-growing fintech tools to define a new standard for transparency.

Singapore commands a massive share of regional funding, capturing 87% of ASEAN’s US$835 million fintech investments in 2025. The move toward sustainability is not a trend—it is now a national financial strategy.

Singapore Green Fintech & the Carbon Exchange Boom

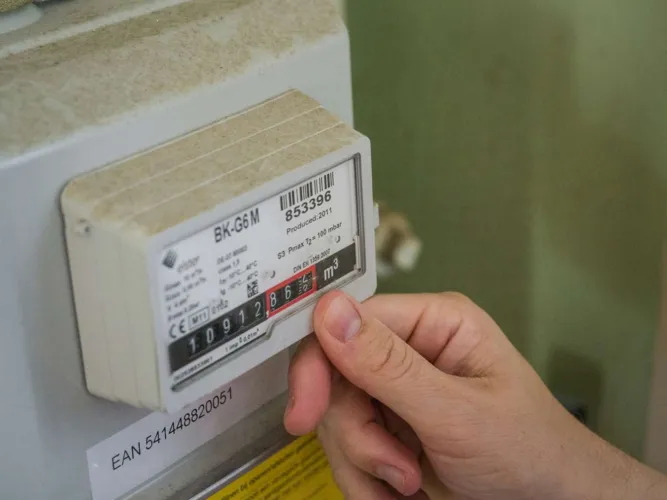

Singapore’s carbon ecosystem is expanding quickly. At the center of this growth is Climate Impact X (CIX), the country’s flagship carbon exchange. CIX benefits from the rise of carbon-credit markets and stronger environmental guidelines across banking and insurance.

Green debt and sustainability-linked loans already make up 96% of all green finance issuance in Singapore. This signals a major shift in investor preference toward climate-aligned assets.

These forces together position Singapore as Southeast Asia’s most advanced green finance market. Fintech investment backs this momentum, with the sector projected to grow from US$12.05 billion in 2025 to US$25.45 billion by 2030, driven heavily by green innovations.

Compliance Tech: The Heart of Automated ESG Reporting

The regulatory landscape is changing fast. From 2025, listed companies must comply with IFRS Sustainability Disclosure Standards. By 2027, large non-listed companies must follow the same rules. This requirement has triggered a surge in demand for automated climate-reporting tools.

Read Also: The Strength of Singapore ESG Finance Hub Fuels Regional Innovation

AI-powered fintech investments rose sharply—from US$24 million in H1’24 to US$160 million in H2’24—as firms race to build solutions for compliance. About 43% of fintechs now focus on emerging technologies that support ESG disclosure.

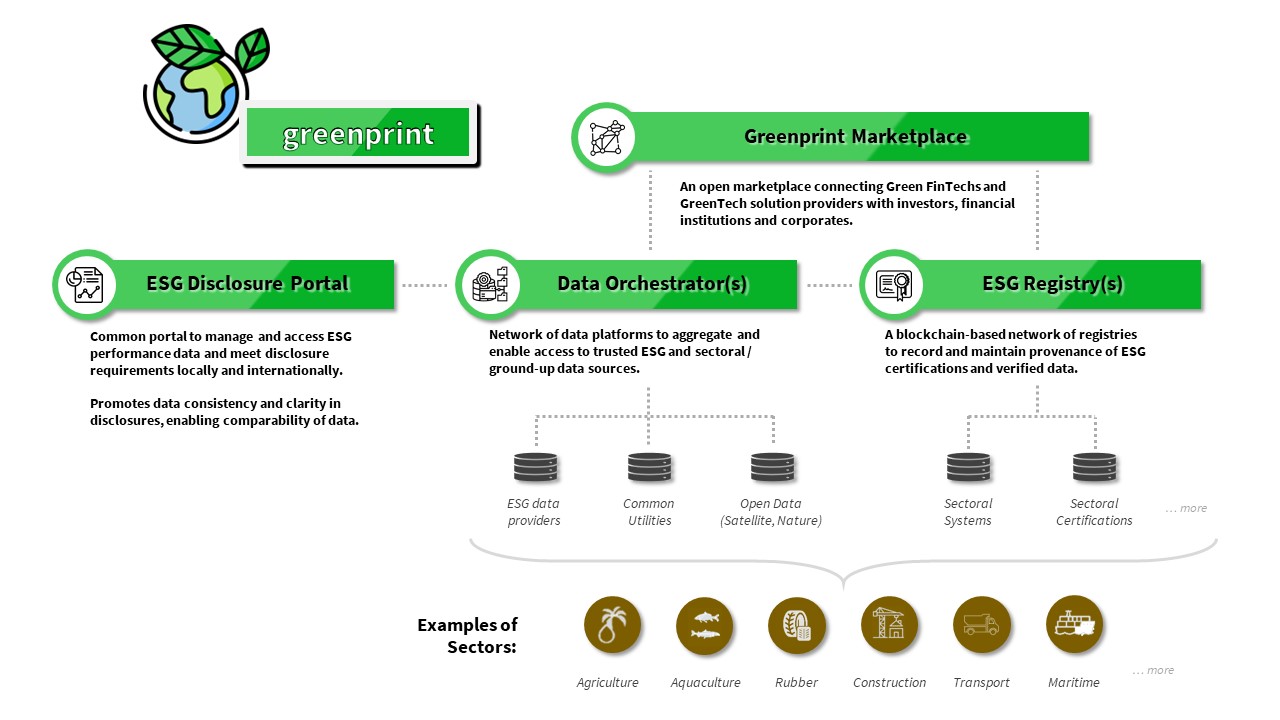

MAS is also pushing digital reporting through the Gprnt platform, which includes the SME Sustainability Barometer 2025. Together, these tools support a new age of automated and verifiable climate reporting—a core pillar of the Singapore Green Fintech landscape.

Family Offices Shift to Green Assets

Family offices are aligning their portfolios with sustainability. In 2025, late-stage fintech deals reached 67% of total funding, with deal values averaging US$112 million. Investors now favor scalable models that deliver real profitability in sustainable sectors.

H2’24 saw a 41% rise in deal values to US$781 million, reflecting a clear preference for climate-aligned investments. Wealth management groups see green portfolios as both resilient and future-proof.

Read Also: DBS-BSF Alliance Fuels Singapore Asia-GCC Corridor's New Era

Read Also: Singapore Green Finance Leadership Launches US$2B Green Transition Facility

Driving Singapore Green Fintech Forward With Confidence

Singapore is building a financial ecosystem anchored in transparency, carbon services, and sustainability technology. The Singapore Green Fintech movement reflects this shift, showing how regulation, investment, and technology align to shape a stronger green-finance future. For deeper insights into this fast-moving space, organizations can connect with Market Research Singapore by Eurogroup Consulting. With over 40 years of distinguished experience, Eurogroup Consulting delivers strategic advisory and market research excellence across the region. Its committed team offers the expertise needed to navigate and succeed in the region’s rapidly evolving market landscape, making it the essential partner for anyone exploring opportunities in Singapore’s growing green-finance economy.