Singapore is leading the charge in green finance across Southeast Asia. Today, the city-state accounts for over 50% of ASEAN’s green financing activity. That dominance didn’t happen overnight—it’s the result of policy vision, fintech innovation, and a clear commitment to sustainable growth.

In just the last 18 months, Singapore issued about SGD 4.8 billion in green and sustainability bonds. Companies also borrowed SGD 10.2 billion through green and sustainability-linked loans. That’s nearly triple the volume seen back in 2018.

Together, green debt and sustainability-linked loans now represent 96% of all green finance issuance in Singapore. It’s a clear signal: investors are actively shifting toward sustainability.

Smart Policy Meets Strategic Innovation

A big part of this growth is regulation done right. The Monetary Authority of Singapore (MAS) rolled out Environmental Risk Management Guidelines that apply across banking, insurance, and asset management. These rules ensure that financial players assess and manage environmental risks effectively.

But regulation alone isn’t enough. That’s why MAS also supports the Green Finance Industry Taskforce (GFIT), which is building a green taxonomy—a common language for what counts as “green” or “transition” finance. This helps avoid greenwashing and makes markets more transparent.

Back in 2019, the government launched the Green Finance Action Plan. Then came the Singapore Green Plan 2030, a bold blueprint for turning Singapore into Asia’s green finance capital. These aren’t just slogans. They're backed by real investments.

The government has committed SGD 100 million to support innovation in green finance. That includes grants for building fintech tools, climate risk analysis platforms, and sustainable insurance models.

Read Also: What Are Singapore Fintech Innovation Landscape Advancements?

Fintech projects like Project Greenprint and the ESG Impact Hub have been launched to encourage collaboration between finance, technology, and sustainability experts. These platforms are helping banks, asset managers, and startups work together to develop new green finance solutions.

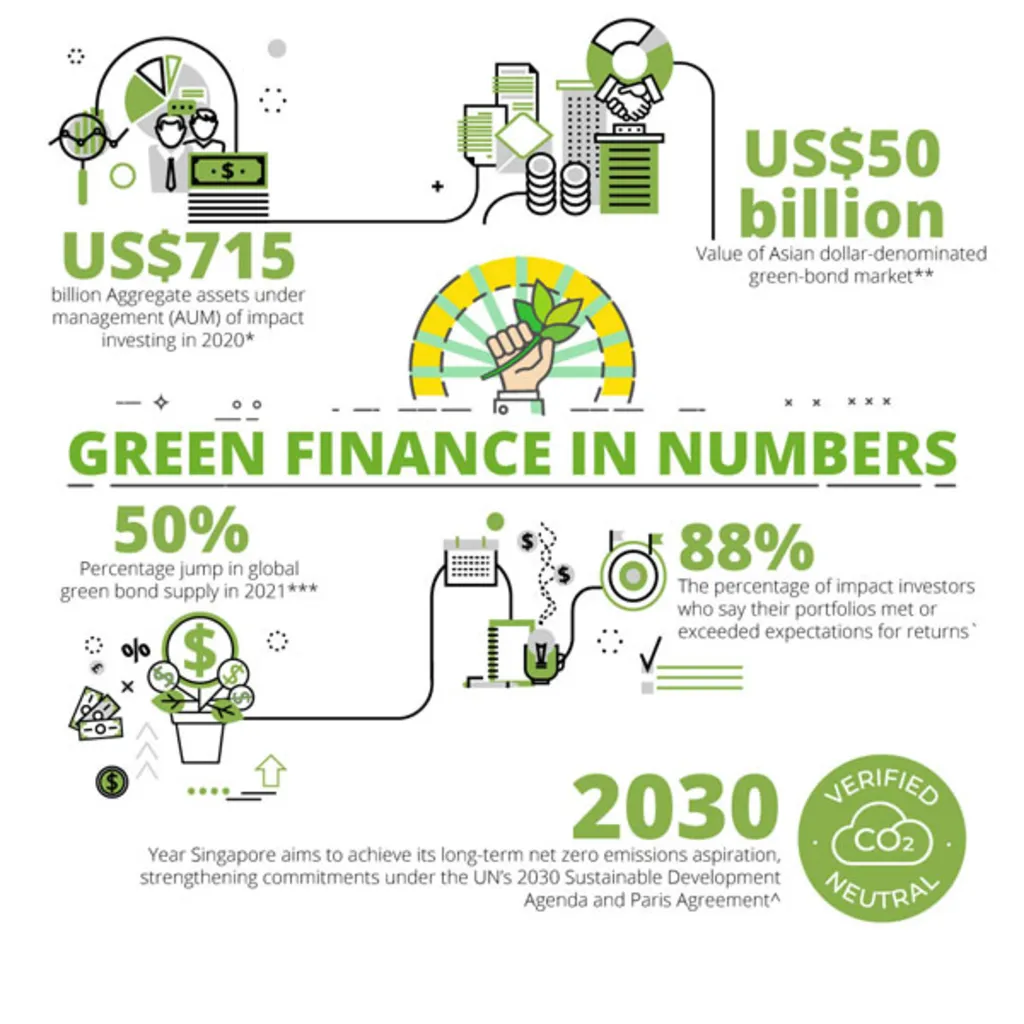

A Market Backed by Real Capital

As of 2019, ESG assets under management in Singapore reached about US$700 billion—roughly 28% of all assets in the country. Since 2017, Singapore has seen over S$33.5 billion in green bonds and loans issued. That makes it Southeast Asia’s largest and most advanced green finance market.

It’s not just size that matters. The structure is maturing too. With regulations to curb risk, a government eager to back innovation, and growing demand for green financial products, Singapore’s green financing ecosystem is becoming a model for the region—and beyond.