Singapore has taken another bold step to cement its Singapore Green Finance Leadership and strengthen its role as Asia’s green finance hub. With the launch of a US$2 billion Green Transition Facility, backed by the Monetary Authority of Singapore (MAS) and DBS Bank, the city-state is demonstrating how strategic public-private partnerships can deploy catalytic capital to accelerate sustainability goals.

A Major Push for Green Finance

The Monetary Authority of Singapore (MAS) announced the new facility under its Green Investments Programme. The fund will channel money into sustainable public market strategies and support companies in their shift toward lower carbon emissions.

On top of this, Singapore pledged up to US$500 million in concessional capital as matching funds. These resources will directly support decarbonization projects in Asia, making Singapore not only a hub for capital flows but also a driver of real-world climate action.

Regional Needs and Singapore Green Finance Leadership

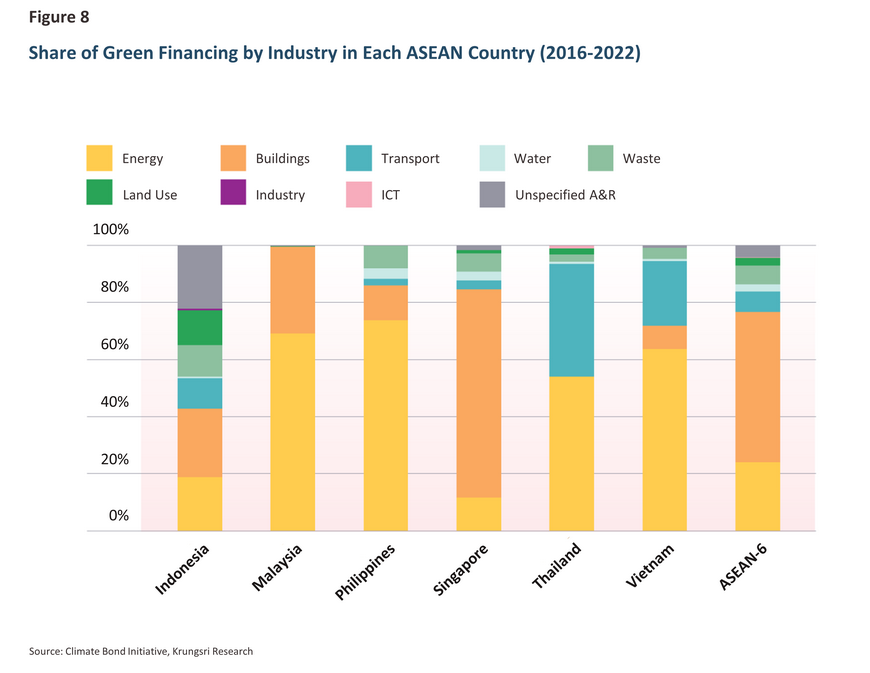

Southeast Asia faces a daunting challenge. The region requires around US$1.5 trillion in sustainable investments by 2030 to meet its net-zero commitments. This figure shows the scale of transformation needed across industries such as energy, transport, construction, and agriculture.

As the region’s leading financial center, Singapore is uniquely positioned to bridge this investment gap. By mobilizing global capital and aligning it with green projects, the country reinforces its standing as the anchor for Singapore Green Finance Leadership.

Read Also: Investors Back Industry 4.0 Singapore's Sustainable Vision

National Green Commitments

Domestically, Singapore has laid out ambitious targets under its Green Building Masterplan. The plan aims to green 80% of all buildings by gross floor area (GFA) by 2030. This initiative underscores the link between finance, infrastructure, and sustainability, showing how the city-state connects investment flows with tangible climate outcomes.

At the same time, Singapore has raised its carbon tax from S$5 per ton of CO2e in 2023 to S$25 in 2024. By 2030, the tax is expected to reach between S$50 and S$80 per ton. This progressive increase is designed to push industries toward cleaner technologies and align with long-term decarbonization goals.

Singapore Green Finance Leadership: Policy Framework for the Future

In 2023, MAS introduced the Finance for Net Zero (FiNZ) Action Plan. This framework set out strategies to mobilize financing across Asia’s green economy. The plan emphasizes:

- Better climate data for informed investment decisions.

- Risk management practices to handle climate-related financial exposures.

- Support for credible transition plans from businesses.

- Innovation in sustainable finance products.

Together, these initiatives form the backbone of Singapore’s effort to lead with credibility and impact in the fast-growing field of green finance.

A Hub for Global and Regional Investors

The Green Transition Facility signals to investors worldwide that Singapore is serious about building a trusted, scalable ecosystem for sustainable finance. By combining regulatory clarity, capital flows, and market innovation, the country is creating conditions where green projects can thrive.

Read Also: How Fintech Fuels Singapore Green Financing Ecosystem

The implications go beyond Singapore’s borders. As industries in Southeast Asia look for ways to cut emissions and transition their operations, Singapore can act as the gateway, connecting international investors with credible local projects. This reinforces the city-state’s role as both a financial hub and a partner in the global climate transition.

Why Singapore Green Finance Leadership Matters

The combination of ambitious local policies and decisive global financial leadership solidifies Singapore Green Finance Leadership and places the nation at the very center of the region’s sustainability story. The Green Transition Facility, carbon tax hikes, and the FiNZ Action Plan are not isolated steps but part of a comprehensive roadmap. By positioning itself at the intersection of finance and climate action, Singapore is ensuring that green finance is not just a slogan but a driver of meaningful change across Asia.

FAQs

1. What is Singapore’s new Green Transition Facility?

It is a US$2 billion fund launched by MAS to support sustainable public market strategies and decarbonization projects.

2. How much concessional capital has Singapore pledged?

Up to US$500 million will be provided as matching funds for green projects in Asia.

3. What are Singapore’s green building targets?

The goal is to green 80% of buildings by gross floor area by 2030.

4. How is Singapore using carbon taxes for sustainability?

The carbon tax is rising from S$25 in 2024 to between S$50-80 per ton by 2030 to encourage decarbonization.

5. Why is Singapore considered a green finance hub?

It combines strong policies, global capital access, and innovative frameworks to drive Asia’s net-zero transition.