Singapore is becoming a global leader in digital finance research. From bold investments to a thriving fintech ecosystem, the city-state is setting the standard for innovation in financial technology. Its approach combines research, regulation, and talent development to create a powerful model for digital finance advancement. Ready to dive deeper into Singapore Digital Finance Research?

A Fast-Growing Digital Economy

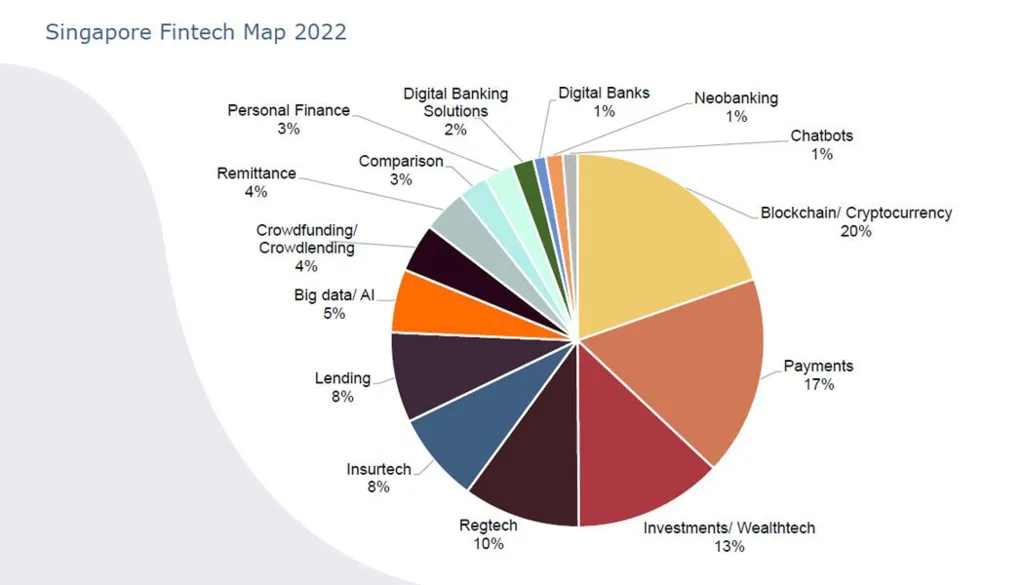

Singapore’s digital economy now makes up 17.3% of GDP, a sharp rise from 13% in 2017. This 12.9% compound annual growth rate (CAGR) far outpaces the overall economy. It reflects Singapore’s strong push into digital services, especially in finance. With over 700 fintech companies, Singapore’s ecosystem is one of the most developed globally. The payments sector alone includes 146 firms, showing how rapidly digital services are expanding.

At the institutional level, Singapore’s banks are outperforming global peers. According to Deloitte’s Digital Banking Maturity report, they score significantly above average on digital capabilities. It is a proof of the country’s deep integration of tech into financial services.

Read Also: What Are Singapore Fintech Innovation Landscape Advancements?

Building Knowledge Through Singapore Digital Finance Research

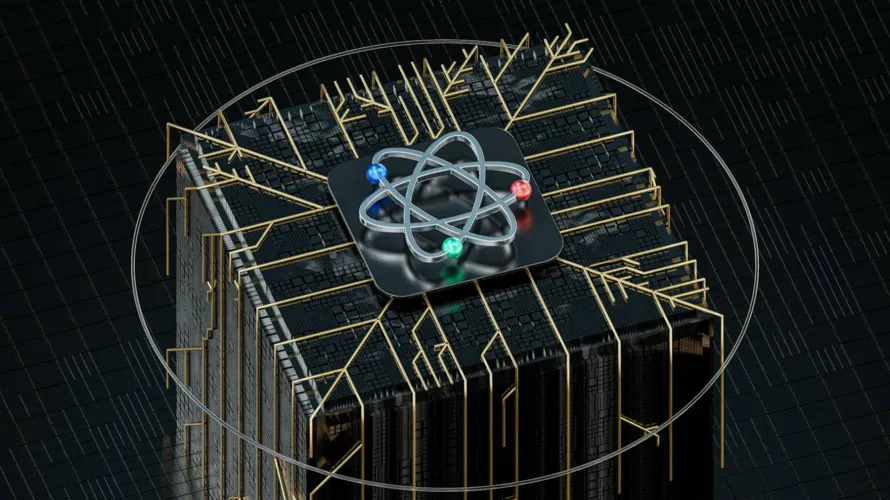

At the heart of Singapore digital finance research is the Asian Institute of Digital Finance (AIDF). Founded by the Monetary Authority of Singapore (MAS), National Research Foundation, and National University of Singapore, AIDF is a hub for research in digital infrastructure, artificial intelligence, anti-money laundering, and cyber fraud.

The institute isn’t just about theory, but also a growing talent. AIDF offers a Master’s program and scholarships for PhDs and post-doctoral research, building a pipeline of fintech leaders not just for Singapore, but the region.

Backing Innovation with Real Investment

Singapore is putting serious money into the future. MAS has pledged up to SGD 100 million under the Financial Sector Technology and Innovation (FSTI) Scheme, aimed at strengthening AI and quantum tech in finance. This funding supports real-world applications and positions Singapore to lead in emerging technologies. The public-private partnership model here is key. Regulatory support makes it easier for firms to test, deploy, and scale new technologies, from tokenized assets to embedded finance platforms.

Read Also: Why Investors Favor Singapore Business Environment Trends

Extending Reach Across Borders

Singapore’s influence goes beyond its shores. Through initiatives like Project Nexus, it is working to enable real-time cross-border payments across ASEAN, using digital infrastructure to boost regional financial inclusion and trade. Such efforts show that Singapore digital finance research is not just about local innovation—it’s about shaping regional systems for the digital age.

Singapore Digital Finance Research: Sustainability Meets Finance

Innovation isn’t just about speed—it’s also about sustainability. Through programs like the Finance for Net Zero Action Plan and partnerships with platforms like GreenArc Capital, Singapore is driving the development of green fintech solutions that align with global ESG standards.

These green initiatives combine digital innovation with environmental responsibility, reinforcing Singapore’s role as a leader in sustainable finance.

Read Also: How Fintech Fuels Singapore Green Financing Ecosystem

Singapore Digital Finance Research is the Model for the Future

The rise of Singapore digital finance research is no accident. It is the result of clear policy, strategic investment, and a strong commitment to education and innovation. With a growing share of GDP, hundreds of fintech companies, and cutting-edge research centers like AIDF, Singapore is building the future of finance. Whether through AI, quantum tech, cross-border payments, or green finance, Singapore is proving that digital finance and research can go hand in hand, to drive both economic growth and global impact.