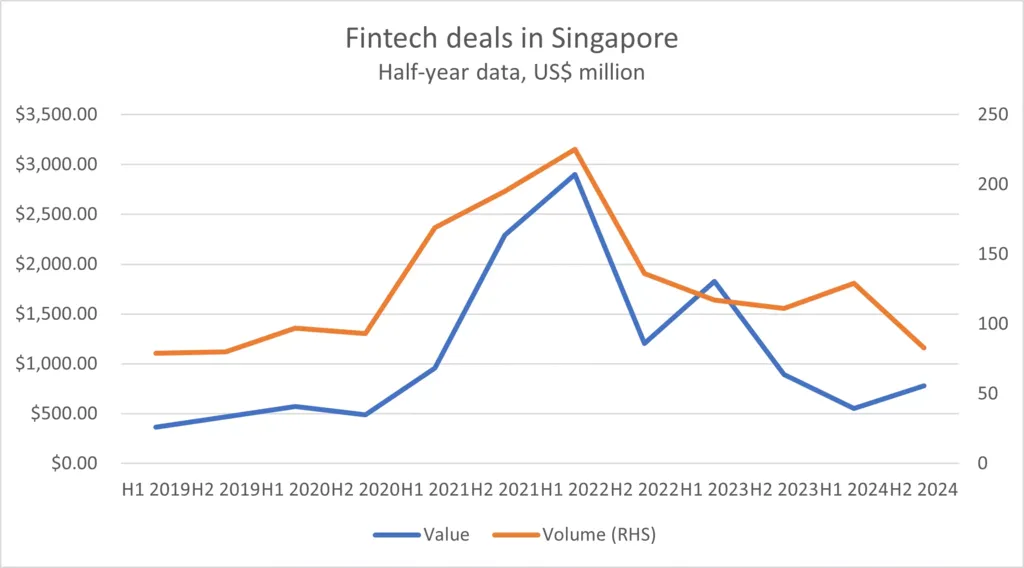

In 2024, global fintech funding fell to a seven-year low of US$95.6 billion. But Singapore stood out. Despite this downturn, it attracted US$1.3 billion in fintech investments. This strength under pressure highlights the Singapore Fintech Innovation Landscape as one of the world’s most resilient and forward-thinking.

The nation’s edge comes from a mix of strong government support, reliable infrastructure, and a digital-savvy population. Even as total funding dropped 60% from 2023, the city-state still closed 115 fintech deals, proving that quality and innovation still drive interest.

Singapore Fintech Innovation Landscape is a Fast-Growing Market

Singapore’s fintech market reached USD 911.3 million in 2024. Looking ahead, it is expected to grow at a compound annual growth rate (CAGR) of 12%, reaching USD 2.53 billion by 2033. This shows clear confidence in the sector’s ability to evolve and meet growing demand for digital financial solutions.

A key sign of this confidence? 80% of fintech professionals in Singapore are optimistic about the sector’s future. This is not just hope—it reflects real investment in tools, tech, and talent that are reshaping financial services.

Read Also: Singapore Financial Services Innovation to Transform the Sector

AI Leads the Innovation Charge

No area grew faster in 2024 than AI-powered fintech. In the first half of the year, AI investments totaled US$24 million. By the second half, that jumped to US$160 million—a sixfold increase in just six months. This reflects a surge in demand for smarter, faster, and more personalized financial services.

AI is already powering fraud detection, credit scoring, customer support, and robo-advisory systems in Singapore. It’s also transforming how digital assets are managed. This contributed to a 22% jump in blockchain and crypto investments in H2 2024, totaling US$267 million. These technologies are improving efficiency, compliance, and security across the board.

In Singapore Fintech Innovation Landscape, Payments Still Dominate

The payments segment remains the most mature area within Singapore’s fintech ecosystem. It continues to attract the largest share of investment, driven by innovations in real-time payments, QR payments, and embedded finance.

These tools are making financial transactions faster and more seamless for users—from businesses to everyday consumers. This consistent performance keeps the payments space at the center of Singapore’s fintech future.

Read Also: Some Hidden Gems in Singapore Financial Sector Insights

Real-World Impact: SGFinDex

Innovation in Singapore isn’t just about hype—it’s changing lives. The Monetary Authority of Singapore (MAS) launched SGFinDex, a platform that connects financial data from seven major banks and multiple government agencies.

Users now get a complete view of their financial health on one dashboard. This makes budgeting, planning, and loan applications much easier. It also helps banks and fintech firms streamline services and offer more personalized advice.

Navigating Challenges, Fueling Growth: Singapore Fintech Innovation Landscape

Yes, the industry saw a steep drop in overall funding—from US$4 billion in 2023 to US$1.6 billion in 2024. But the drop must be viewed in context. Global uncertainty played a role, and Singapore’s ability to still raise over a billion dollars shows deep-rooted confidence.

Rather than slowing down, the ecosystem is evolving. With help from initiatives like the National AI Strategy Roadmap 2.0 and the proposed ASEAN AI regulatory framework, Singapore is ensuring innovation doesn’t come at the cost of stability or jobs.

A Future-Ready Fintech Hub

The Singapore Fintech Innovation Landscape is adapting quickly. AI, blockchain, and real-time data tools are making financial services faster, smarter, and more inclusive. And with strong institutional support, Singapore is positioned not just to recover—but to lead the next chapter of global fintech innovation.