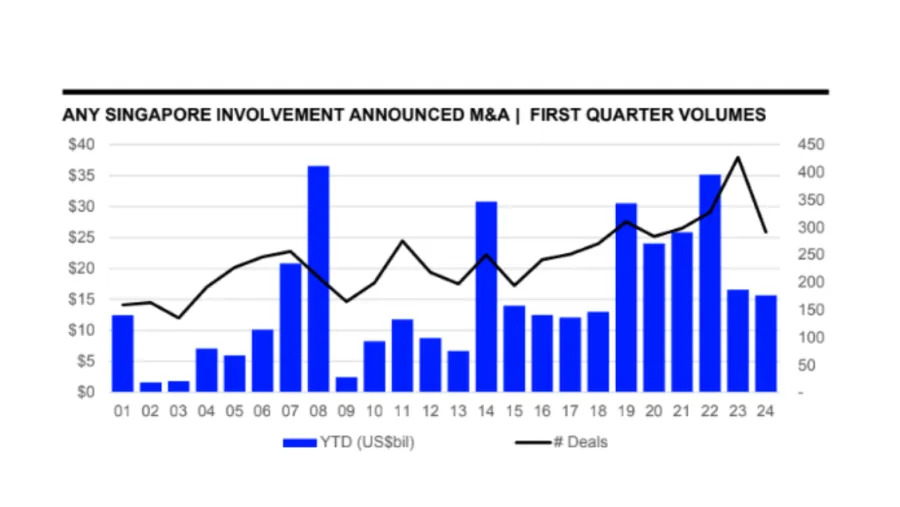

Singapore is facing a challenging M&A environment in 2024. While the broader Asia-Pacific region is seeing increased optimism for acquisitions, Singapore is dealing with a Singapore M&A slowdown concern. Deal volumes have fallen sharply, even as deal values rise, showing a market shaped by uncertainty and selectivity.

Singapore M&A Slowdown Concern: Sharp Drop in Deal Volumes

Singapore’s M&A deal volume fell by 25.5% year-on-year in the first nine months of 2024. Outbound M&A also dropped by 24%, hitting a nine-year low of USD 14.7 billion.

The slowdown reflects global headwinds such as rising geopolitical tensions, shifting trade policies, and ongoing interest rate uncertainty. The imposition of tariffs in 2025 added further hesitation, causing some deals to be delayed or canceled. Companies are cautious, and investors are weighing risks more carefully before pursuing acquisitions.

Deal Values Tell a Different Story

Despite lower volumes, total M&A deal values in Singapore rose by 29%, reaching USD 51 billion in the first nine months of 2024. Notably, there were eight transactions valued above USD 1 billion.

The financial sector led the rise with a 36% increase, while real estate deals grew by 16.2% compared to 2023. This shift suggests that although fewer deals are being completed, those that go through tend to be large, strategic transactions.

Outbound Weakness vs Domestic Strength

The most significant weakness was in outbound M&A. With global trade policies uncertain and rising protectionist measures, many Singapore companies held back from making overseas acquisitions.

On the other hand, inbound M&A rose 50.4%, and domestic activity increased by 15%. These figures highlight a tilt toward deals that focus on Singapore’s internal market or attract foreign investors into the country. Local strengths in finance and real estate continue to anchor activity, even as global conditions weigh on outbound expansion.

Read Also: Digital Spend Slows in Singapore, but Still Strong. So What's Changing?

APAC Outlook More Optimistic, Singapore M&A Slowdown Concern Remains

The regional picture contrasts sharply with Singapore’s slowdown. Across Asia-Pacific, confidence is strong:

- 85% of CEOs in the region expect opportunities in global markets.

- Over 60% are planning M&A engagements despite global uncertainties.

This optimism reflects growth expectations in emerging economies and expanding regional supply chains. Singapore’s cautious outlook, therefore, stands out against the more positive sentiment across APAC.

Global Context: Fewer Deals, Bigger Values

Globally, M&A volumes fell 9% in the first half of 2025, but deal values rose 15%. This mirrors Singapore’s trend of fewer but larger transactions. Investors appear to be prioritizing quality over quantity, committing resources only to deals that deliver long-term strategic value.

Balancing Risks and Opportunities

The Singapore M&A slowdown concern underscores the challenges of navigating global uncertainty while remaining competitive. Lower volumes point to hesitation, but higher values show that Singapore is still capable of attracting and executing big-ticket deals. If global conditions stabilize, particularly around tariffs, trade, and interest rates, then outbound activity may recover. In the meantime, Singapore’s strength lies in its financial and real estate sectors, supported by resilient inbound and domestic deal-making.

Read Also: Across Industries: Singapore AI Integration Strategy & Playbook

FAQs

1. Why is Singapore experiencing an M&A slowdown?

Deal volumes dropped due to tariffs, geopolitical tensions, and uncertainty over global interest rates and trade policies.

2. Did Singapore’s M&A market decline in value as well?

No, total deal value actually rose 29% to USD 51 billion in 2024, despite fewer deals.

3. Which sectors drove Singapore’s deal value growth?

Finance led with a 36% increase, followed by real estate at 16.2%.

4. How does Singapore compare with the Asia-Pacific region?

While Singapore slowed, APAC CEOs remain optimistic, with most planning acquisitions.

5. What global M&A trend does Singapore reflect?

Globally, volumes fell 9% in 2025, but deal values rose 15%, showing fewer but larger transactions.