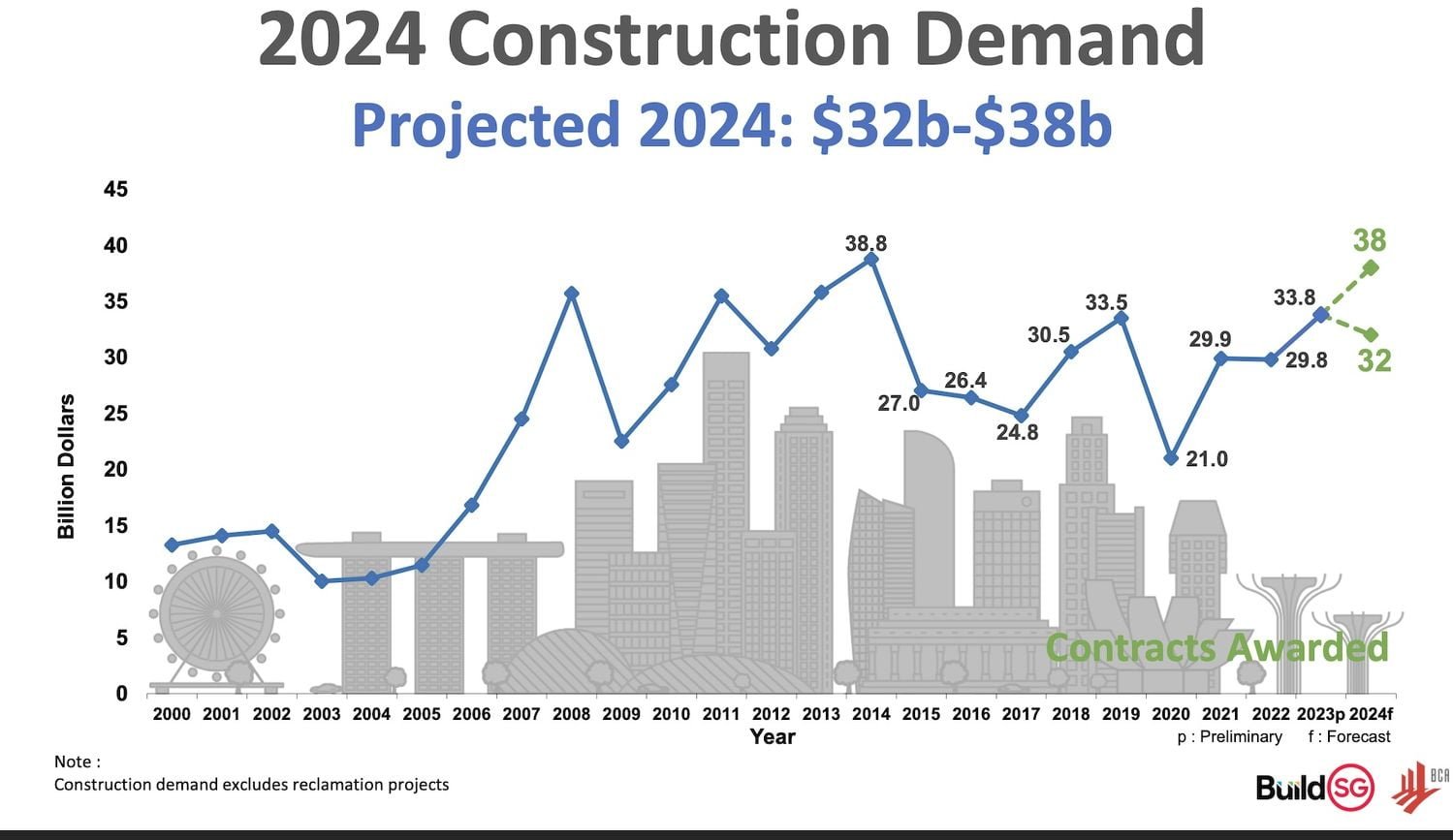

Singapore, known for its urban innovation and forward-thinking infrastructure, is set for another year of robust growth in its construction sector. Looking at Singapore Construction Market Trends 2024, the industry is projected to experience steady development, driven by a diverse range of projects across both the public and private sectors.

According to the Building and Construction Authority (BCA), total construction demand will range between S$32 billion and S$38 billion. This positive outlook signals opportunities for businesses in the construction industry, both locally and internationally, to thrive in the coming year.

A Diverse Project Portfolio

The expected demand in 2024 will be fueled by a mix of public and private sector projects. On the public side, construction demand is expected to range between S$18 billion and S$21 billion.

Major infrastructure projects like the Cross Island Line (Phase 2), HDB housing developments, and large-scale expansions at Changi Airport Terminal 5 and Tuas Port are key contributors. These projects not only support the growth of public infrastructure but also align with Singapore’s vision of maintaining world-class facilities.

Private sector projects will also play a significant role, contributing an estimated S$14 billion to S$17 billion. The private construction market includes residential projects, commercial premises redevelopments, and industrial facility expansions. This balance between public and private initiatives highlights the resilience and adaptability of Singapore’s construction sector.

Regulatory Changes Impacting the Industry

In 2024, several regulatory changes will shape the construction landscape. One of the most significant changes is the reduction in the foreign worker quota. The Dependency Ratio Ceiling (DRC) has been adjusted from 1:7 to 1:5, meaning companies will need to hire one local worker for every five foreign workers. This shift aims to promote local employment and reduce the industry’s reliance on foreign labor.

Another key change is the introduction of the Off-site Levy Scheme (OLS), which incentivizes the use of off-site construction technologies like Design for Manufacturing and Assembly (DfMA). With levy rates as low as S$250 per worker, companies are encouraged to adopt modern construction techniques that improve efficiency and reduce labor costs.

Additionally, the Mandatory Top Executive Workplace Safety and Health (WSH) Programme requires CEOs and Board Directors to attend a one-off course by March 2024. This regulation emphasizes workplace safety, which is crucial to the long-term success of the industry.

Emerging Singapore Construction Market Trends 2024

Several emerging trends are also reshaping the future of construction in Singapore. One of the most important trends is the increased adoption of technology. Tools like Building Information Modeling (BIM), drones, and construction management software are becoming essential to enhancing productivity and precision on construction sites.

Sustainability is another trend gaining traction. As the world becomes more conscious of environmental issues, Singapore’s construction industry is moving toward eco-friendly practices. The use of renewable materials and energy-efficient designs is expected to grow as the government continues to promote sustainability.

Finally, urbanization is creating a strong demand for affordable housing. With rapid population growth, the need for housing solutions has never been higher. The government has set an ambitious goal to build one million social housing units by 2030, creating a significant demand for construction companies to meet this target.

The Singapore Construction Market Trends 2024 promises steady growth, driven by a diverse portfolio of projects and influenced by new regulations and emerging trends. The industry’s ability to embrace technological advancements, prioritize sustainability, and adapt to regulatory changes will determine its success. With significant opportunities in both public and private sectors, the future looks bright for construction companies in Singapore.