Singapore’s success in affordable housing is globally recognized. Despite being one of the world’s most densely populated nations, with 5.5 million people living on a mere 720 square kilometers, it has an impressive homeownership rate of over 80%. This achievement is underpinned by a strategic government approach and private sector involvement. Despite the unique challenges of limited land and high demand, the country is ensuring Affordable Housing Singapore.

Government Policies: The Backbone of Affordable Housing Singapore

Since the 1960s, Singapore’s government has championed affordable housing through three key policies:

- First, the Housing and Development Board (HDB): The primary provider of public housing, ensuring that most citizens have access to affordable homes. These HDB flats are sold at below-market rates, making them accessible to middle- and lower-income families.

- Second, the Central Provident Fund (CPF): A government-managed retirement scheme, plays a vital role in homeownership. Singaporeans can withdraw from their CPF savings to fund housing purchases, reducing reliance on traditional loans and mortgages.

- Third, the Land Acquisition Act: This allows the government to acquire private land for public purposes, including building Affordable Housing Singapore. This regulation ensures that Singapore’s limited land is maximized for public good, making space for more housing developments.

Affordability and Supply Challenges

The balance between housing supply and demand is delicate in Singapore. The COVID-19 pandemic severely disrupted the construction industry, slowing the supply of new flats and pushing up market prices. Although the government responded quickly, announcing plans to build 100,000 new flats between 2021 and 2025, the supply crunch affected Affordable Housing Singapore. As a result, many potential buyers struggled to find flats that met their budget or preferred location.

Another factor impacting supply is rising construction costs and supply chain disruptions. Even before COVID-19, these issues added pressure to housing prices, further complicating affordability. The government has been trying to offset this through subsidies, which help first-time buyers afford HDB flats.

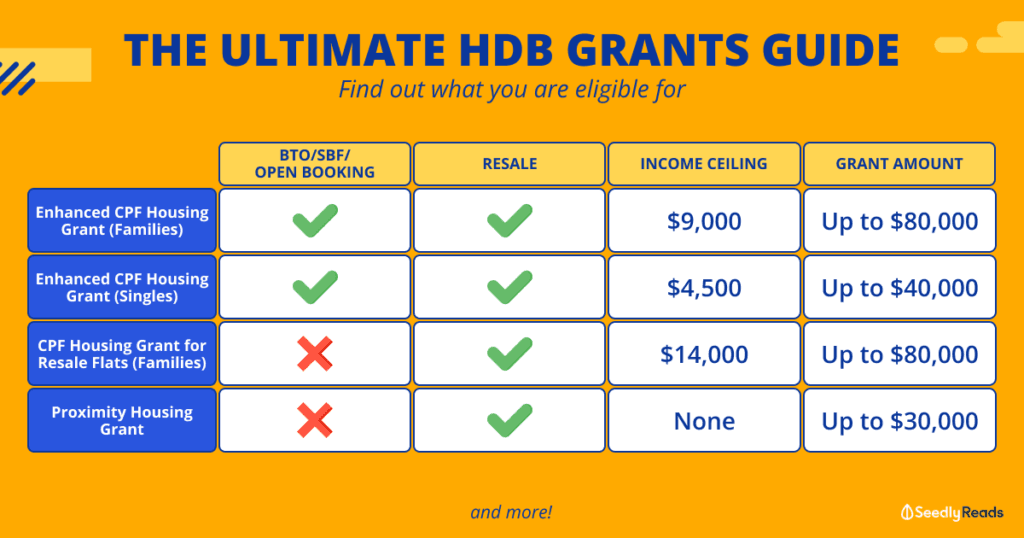

Addressing Affordability: Subsidies and Grants

To combat rising costs, the Singaporean government offers substantial subsidies and grants, particularly aimed at low- and median-income households. In 2022, the government estimated that 70% of BTO flats were part of Affordable Housing Singapore for households with a median income of S$8,400/month. Additionally, the mortgage servicing ratio was capped at 25%, ensuring that families could manage home loans without becoming financially strained.

For families that still find homeownership out of reach, rental options are available. However, only 6% of public housing stock is allocated for rental purposes, mainly reserved for older or more vulnerable citizens. For younger families, renting is considered a temporary option until they are able to purchase their own homes.

Private Sector Contributions

While the government leads the public housing initiative, the private sector plays a crucial role in building private housing for wealthier citizens. Recently, the government has been releasing more land for private housing developments to alleviate pressure on the public housing market. This strategy aims to ensure that middle-income citizens have choices, while also keeping public Affordable Housing Singapore for those who need it most.

Opportunities Moving Forward

Despite the challenges, Singapore’s housing policies remain resilient. The government’s ongoing efforts to increase housing supply and provide financial assistance reflect its commitment to making housing accessible for all citizens. As Prime Minister Lawrence Wong mentioned in August 2024, the backlog of housing construction caused by the pandemic is being cleared, with the government’s goal of building 100,000 new flats on track.

In conclusion, Affordable Housing Singapore is a continuous balancing act. Land scarcity, rising costs, and high demand all pose significant challenges. However, the government’s proactive policies, combined with private sector contributions, offer a promising path forward.